Many factors influence the volume of dwellings in the pipeline and the progress of dwellings from strategic planning to occupancy. The NSW Government is monitoring the housing supply pipeline in NSW across 5 stages: strategic planning, zoning, infrastructure servicing, development approval and construction and completion. In addition, four targets are used to monitor quarterly progress in 2022-23.

This report includes data for the June quarter and provides the final report against interim targets for 2022-23.

| NSW housing targets 2022 | ||

|---|---|---|

| Zoning | 100,000 dwellings unlocked by 2023–24 (including 70,000 dwellings from state-led rezoning approvals and 30,000 dwellings from council-led rezoning approvals) | Interim target: 50,000 dwellings by June 2023 |

| Infrastructure servicing | 150,000 dwellings supported by housing-focussed infrastructure programs by 2025–26 | Interim target: 37,500 dwellings supported by June 2023 |

| Development approval | 32,500 dwellings unlocked by 2023–24 (from state-significant and regionally significant development approvals) | Interim target: 16,250 dwellings by June 2023 |

| Housing supply in regional NSW | 127,000 dwellings delivered in regional NSW by 2031–32 | Interim target: 12,700 dwellings by June 2023 |

Stage 1: Strategic planning

Local Housing Strategies

The department is working closely with Greater Sydney councils to help them reach local housing supply targets through implementation of the local housing strategies.

During the June quarter, the department approved an updated LHS for Penrith City Council. The department and Plan NSW engaged with Greater Sydney councils to consider progress to deliver housing strategies and implications for new housing targets to be set in 2023-24. The department is also developing a new guideline and template for councils LHS and Implementation and Delivery Plans to support consistent coordination and delivery.

As at 30 June 2023, all Greater Sydney councils have a LHS in place and 32 out of 33 have submitted an Implementation and Delivery Plan, or equivalent strategic works programs, to plan for housing delivery.

Stage 2: Zoning

State and council-led rezoning

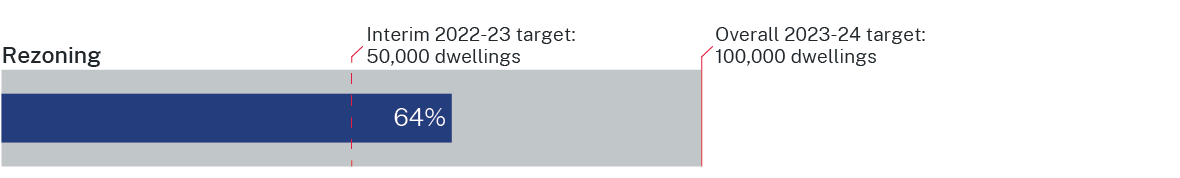

Financial year progress on interim and overall rezoning targets

In the June quarter, 42,808 lots were rezoned in NSW from approved planning proposals. This includes 14,000 rezoning lots as part of the Consolidated Canterbury-Bankstown LEP, 12,900 dwellings from the Appin precinct in Wollondilly and 2,270 rezoning lots as part of the Laffing Waters Master Plan in Bathurst.

In 2022-23, 64,289 lots were rezoned for residential development across NSW (exceeding the interim target to June 2023 by 29%). An additional 43,848 lots are scheduled to be rezoned by 30 September 2023 from 63 planning proposals. This comprises 41,340 lots in Greater Sydney and 2,508 in regional areas.

NSW has met the target for council-led planning proposals and has state-led rezonings underway to deliver 70,000 dwelling lots in the 2 years to June 2024.

The department will continue to monitor dwellings from state-led rezonings and planning proposals in the 2023-24 financial year.

Stage 3: Infrastructure servicing

Financial year progress on interim and overall infrastructure servicing targets

In the June quarter, the department executed funding agreements for 36 Accelerated Infrastructure Fund projects announced in March. These funding agreements total $254 million and will deliver housing-related infrastructure for 138,493 dwellings across 26 Greater Sydney and 10 regional projects.

In 2022-23, the Accelerated Infrastructure Fund, the Regional Housing Fund, Special Infrastructure Contributions, State Voluntary Planning Agreements and other related programs supported 182,231 dwellings, exceeding the target 150,000 announced in 2022.

Stage 4: Development approval

State and regionally significant approvals

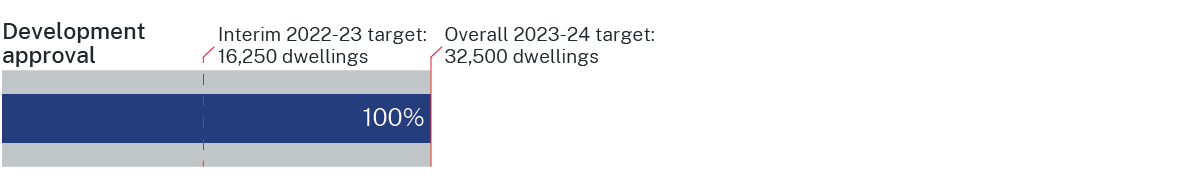

Financial year progress on interim and overall development approval targets

In the June quarter, 3,573 dwellings were approved as part of a state or regionally significant development. Of these approvals, 3,011 (84%) were in Greater Sydney and 562 (16%) in regional NSW. This includes 811 dwellings as part of a mixed use development in Castle Hill and 232 dwellings as part of a residential development in St Leonards.

In 2022-23, 32,684 dwellings were approved as part of a state or regionally significant development, with 86% in Greater Sydney and 14% in regional NSW. This exceeds the 32,500 target announced in 2022.

Local development approvals

In the June quarter, local government approved 17,820 dwellings from local development applications.

In 2022-23, over 85,095 dwellings have been approved as part of a local development assessment. Approximately 63% of these dwellings are part of a multi-unit development.

Stage 5: Construction and completion

Financial year progress on interim and overall regional dwellings targets

In regional NSW, 3,194 dwellings received construction approval during the June quarter.

In 2022-23, 13,272 regional dwellings have received construction approval, exceeding the interim target for 2022-23 by 5%. Note this data reflects dwelling construction approval from complying development and construction certificates reported in the NSW Planning Portal and is not comparable with ABS building activity data which uses a different methodology.

In 2022-23, ABS data shows that building approvals were down 4% (52,746 dwellings) compared to the previous year. Multi-dwelling approvals were 53% of total construction approvals, whereas at the peak in 2016 this was around 60%.

Residential building approvals have fallen since mid-2021, driven by multiple factors, including shortages of construction material and labour, rising interest rates, and falling housing prices.

Dwelling commencements were down 20% in the 12 months to March 2023 (49,189 dwellings) compared to the previous year. The number of dwelling completions has remained stable in the 12 months to March 2023 (47,430 dwellings) compared to the previous year (47,513), but this remains below previous years and is indicative of a sustained downward trend in completions.

Under the National Housing Accord, NSW has committed to contributing to the aspirational national target of 1.2 million new 'well-located' homes between 2024 and 2029. NSW has a goal to deliver 376,000 dwellings, in line with its population share. The department is reviewing its framework for monitoring and reporting on housing supply activity and reform measures implemented to support housing supply and affordability.

NSW building approvals (quarterly)

Source: Australian Bureau of Statistics, Building Approvals, Australia (original) (data to June 2023)

NSW building completions (quarterly)

Source: Australian Bureau of Statistics, Building Approvals, Australia (original) (data to March 2023)

Housing supply pipeline – key indicators summary

| Target | Q4 (Apr-Jun 2023) | FY 2022-2023* | |

|---|---|---|---|

| Strategy Planning | Number of IDPs submitted to DPE | 0 | 32 |

| Zoning | Potential dwellings unlocked through rezoning lots | 42,808 | 64,289 |

| Infrastructure servicing | Potential dwellings supported by new NSW infrastructure programs | 138,493 | 182,231 |

| Approvals | Potential dwellings unlocked through approvals (state and regionally significant) | 3,573 | 32,684 |

| Potential dwellings unlocked through Local Development Applications | 17,820 | 85,095 | |

| Construction and completions | Number of dwellings with construction approval in regional NSW | 3,194 | 13,272 |

*YTD totals include dwellings from planning decisions applied retrospectively in the Planning Portal.